Centralized Finance (CeFi) vs Decentralized Finance (DeFi) - The Battlefield of Cryptocurrencies

Not very long ago, the financial world witnessed a revolution with the advent of Bitcoin and Blockchain. Cryptocurrencies were invented with the intent of decentralizing the financial trading system but they were just limited to crypto trading. However, going a step further Decentralized Finance (DeFi) exchanges came into picture, that not only supported the trading aspect of cryptocurrencies but also had several use cases like lending crypto loans, crypto derivative trading like Bitcoin Futures, tokenizing digital assets etc. Learn more about Decentralized Finance (DeFi) and their applications .

In this blog, let us see how is Decentralized Finance (DeFi) different from Centralized Finance (CeFi), what are their pluses and minuses and which is most favourable in the world of crypto-finance and its related applications.

What is Centralized Finance (CeFi) and Decentralized Finance (DeFi)?

Right from when cryptocurrency was discovered, businesses have been looking for ways to use it for different kinds of financial services. To manage them, there are two different platforms that are available,

1) Centralized Finance (CeFi) exchanges - act as an intermediary to manage the crypto transactions and activities of users

2) Decentralized Finance (DeFi) exchanges - which eliminate the need of any third party to control the activities of users, thus allowing technology to take over and users having authority to manage their transactions and deals.

The main motive of both Decentralized Finance (DeFi) platforms and Centralized Finance (CeFi) platform remains the same i.e. to facilitate people to use cryptocurrencies for all of their financial needs and services. But the way they both execute is different. Let us see how.

(Blockchain Simplified is a top Blockchain development company in Pune, India. Visit us at https://blockchainsimplified.com)

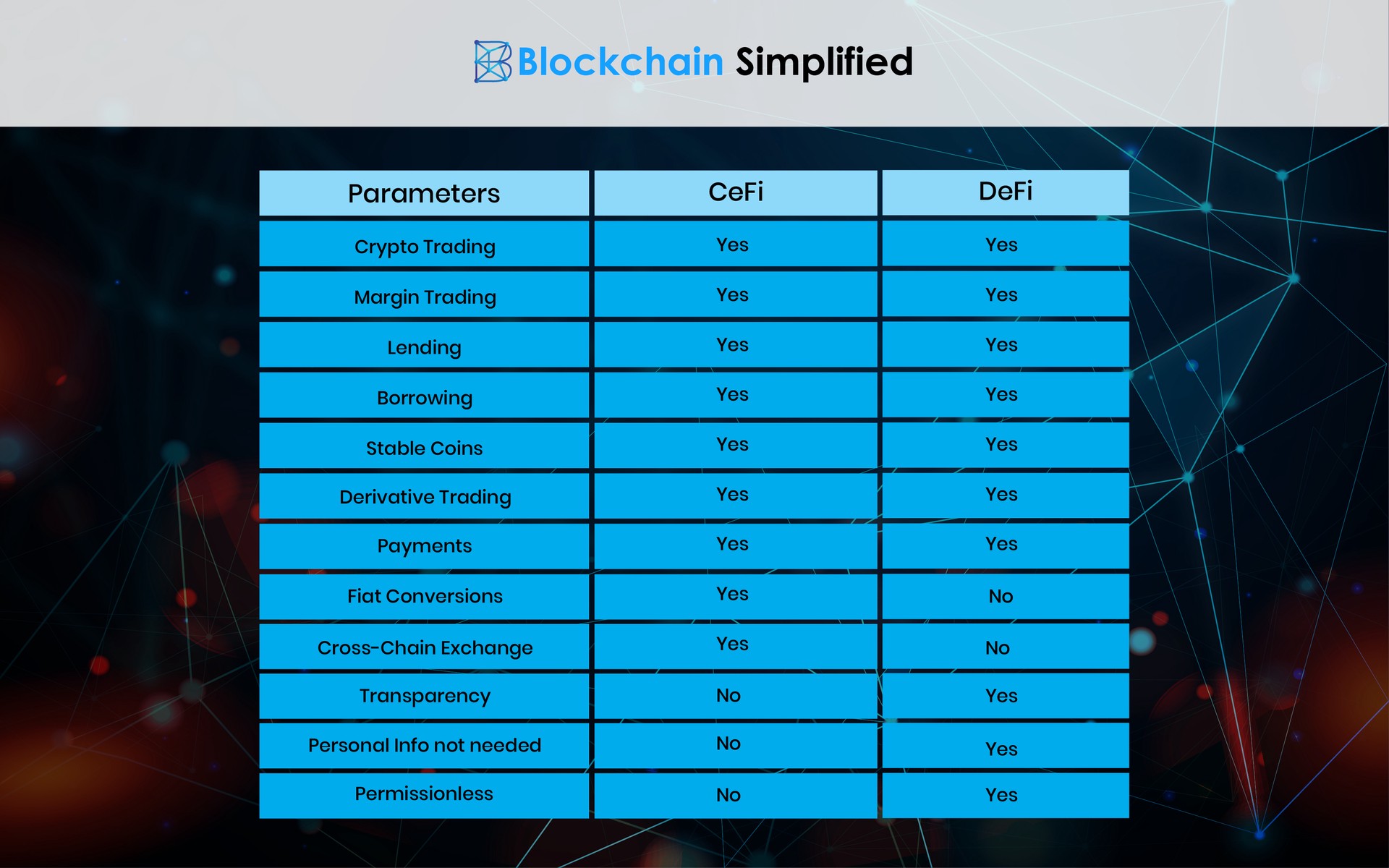

Difference between Centralized Finance (CeFi) and Decentralized Finance (DeFi)

Centralized Finance (CeFi)

There are many ways in which Centralized Finance (CeFi) differs from Decentralized Finance (DeFi). Binance, Coinbase, Libra etc are well-known CeFi exchanges that have been carrying out crypto-financial services for quite some time now. Users typically create an account with these companies and use the platform to primarily transfer and receive funds. But these exchanges not only provide crypto trading services but also support other services like lending, borrowing, margin trading etc. Hence, the more the number of services a CeFi exchange provides, the more the number of users. Since these are entities that are established and have been there for a while, users trust these platforms while providing intimate and confidential information about themselves. However, since these are centralized in nature, there is always a possibility of data security breach and thefts as these platforms are susceptible to cyber attacks and data leaks.

One of the many advantages of Centralized Finance (CeFi) over Decentralized Finance (DeFi) is that they support cross chain exchange for multiple cryptocurrencies, although these cryptos are generated on individual blockchains, thus displaying interoperability of cryptocurrencies. CeFi exchanges also enable the conversion of fiat currency to cryptocurrency and vice-versa in an easy and seamless manner.

Decentralized Finance (DeFi)

Due to its decentralized structure, DeFi is hands down the best when it comes to protection of personal data. Users are the sole owners of their data, hence there is no chance of funds being stolen or misused or vulnerable to thefts. Users are responsible for managing their own funds and activities. As Decentralized Finance (DeFi) is hosted on a Blockchain platform like Ethereum, smart contracts are designed to automatically execute transactions when a particular condition is fulfilled. Since smart contracts are automatic, users can be fully assured that transactions will never fail and will be properly executed. Users do not require any permission to join a Decentralized Finance (DeFi) exchange since it is permissionless, which is not the case in Centralized Finance (CeFi) platforms.

But, DeFi exchanges have been lacking in providing services like cross chain exchanges. Since the process of cross chain exchange is cumbersome and complicated, DeFi platforms fail in providing this interoperability. But with growing technology, Decentralized Finance (DeFi) exchanges have been able to provide alternatives in this regard. Read this article on DeFi solutions to Bitcoin to know more.

Some of the biggest examples of Decentralized Finance (DeFi) exchanges are Kyber, Totle, MakerDAO etc.

(To hire the best Blockchain developers, visit us at https://blockchainsimplified.com)

Centralized Finance (CeFi) vs Decentralized Finance (DeFi)

The battle between Centralized Finance (CeFi) and Decentralized Finance (DeFi) is always on and continuing. There are pros and cons of both, depending on which one you want to choose for your requirement of crypto-financial services.

About Blockchain Simplified

Blockchain Simplified is a Top blockchain development company in Pune - India which works on all major Blockchain requirements. We specialise in Blockchain, Web and Mobile development (One Stop Shop for all technology development needs).

Our clientele includes Multiple Funded Start - Ups, SMBs and few MNCs few of which are NASDAQ and NSE listed.

Some of our work includes,

Blockchain based-

hubrisone.com - is a Live app with 100,000+ downloads, All-in-One Cryptocurrency current account. The entire development from scratch carried out by Blockchain Simplified.

All in one Platform - Complete responsibility of entire software development of the platform ,for a $1m funded blockchain start up, led by a team of serial entrepreneurs and tech veterans in Silicon Valley.

Well funded Blockchain startup - Blockchain Simplified helped a $6m funded American Blockchain startup to build the first blockchain protocol to leverage on-chain smart contracts to manage distributed storage of application data off-chain.

Multinational Bank - The company helped one of the top 3 ranking Multinational Banks to integrate various cryptocurrencies into their banking application.

and more…

Non-Blockchain-

SHC - Built entire platform and app from scratch for a $1m funded startup led by a team of Americans including PhD degree holders.

VMW - Developed app for a multi-national company providing mass factory-to-factory shipment services. App is being used by 53 of the Fortune 500 companies such as John Deere, Coca-Cola, Nissan.

and more…

Expertise

Blockchain Development : Bitcoin, Ethereum, Hyperledger, Corda, and more.

Mobile App Development : Android Native, iOS Native, React Native, Flutter, Xamarin.

UI/UX Design : Strategy, Planning, UI/UX Design, Wireframing, Visual Designs.

Web App Development : Node.JS, Angular, React.JS, PHP.

Backend Development : MongoDB, MySQL, AWS, Firebase.

Visit our official website https://blockchainsimplified.com/ for more information.