The rise of Crypto Derivatives trading

The birth of Decentralized Finance and Blockchain based Cryptocurrency trading has refurbished the crypto market in the last couple of years. DeFi exchange platforms have introduced different developments and advanced options to promote the trading of cryptocurrencies like Crypto loans, asset tokenization, creating stablecoins etc. One such amazing service offered on DeFi platforms are the Crypto derivatives, the most popular one being Bitcoin Futures.

Ever since Chicago Board Options Exchange (CBOE) and Chicago Mercantile Exchange (CME) launched Crypto Derivatives trading, namely Bitcoin Futures on their platform, there is a growing interest associated with it. In fact such is the popularity of Bitcoin Futures, that it enjoys a staggering 40-50% growth in the average daily volume.

So what exactly are these Crypto derivatives? What is the reason for the Crypto derivatives trading market to witness exponential growth since its inception? Why is every exchange platform considering offering the option of Crypto derivatives trading to its users?

What is Crypto Derivatives Trading?

Before we understand the meaning of Crypto Derivatives trading, let us go back a little and understand what is derivatives trading? In the world of financial markets and investments, derivatives are contracts that represent a deal to sell or buy an asset or a commodity or any financial instrument at a pre-decided price on a pre-decided date in future, between two parties. In the case of Crypto Derivatives trading, the two parties agree on a contract that speculates on the prices of cryptocurrencies on a particular date in future. On the date of contract execution, the two parties have to oblige upon the selling price and the buying price of the crypto, irrespective of the market price (whether its fallen or risen) on that particular date.

Crypto Derivatives trading can either be done on CeFi or DeFi exchanges or customer-to-customer (C2C). Derivatives trading is generally used to hedge against the risk of volatile assets, particularly those which experienced sudden price fluctuations. The purpose of Derivatives trading is not to gain profit but to mitigate risks against a volatile asset. For instance, if a trader predicts that Bitcoin might see an increase in its price in future, he/she can invest in buying some Bitcoins or else if he/she owns some Bitcoins and foresees a fall in Bitcoin’s price in future, he/she can sell them off, to avoid losses.

The Derivatives trading market is quite a shaky one and that is why Warren Buffet called them as financial weapons of mass destruction. But there are some very interesting use cases of derivative trading that can be applied in real life. For instance, there are many airlines operating in the US that hedge against the volatile oil prices, thus managing to pay less than their competitors. Read this article on the ways Airlines Hedge against Oil prices using derivatives trading..

(Blockchain Simplified is a top Blockchain development company in Pune, India. Visit us at https://blockchainsimplified.com)

Types of crypto derivatives trading

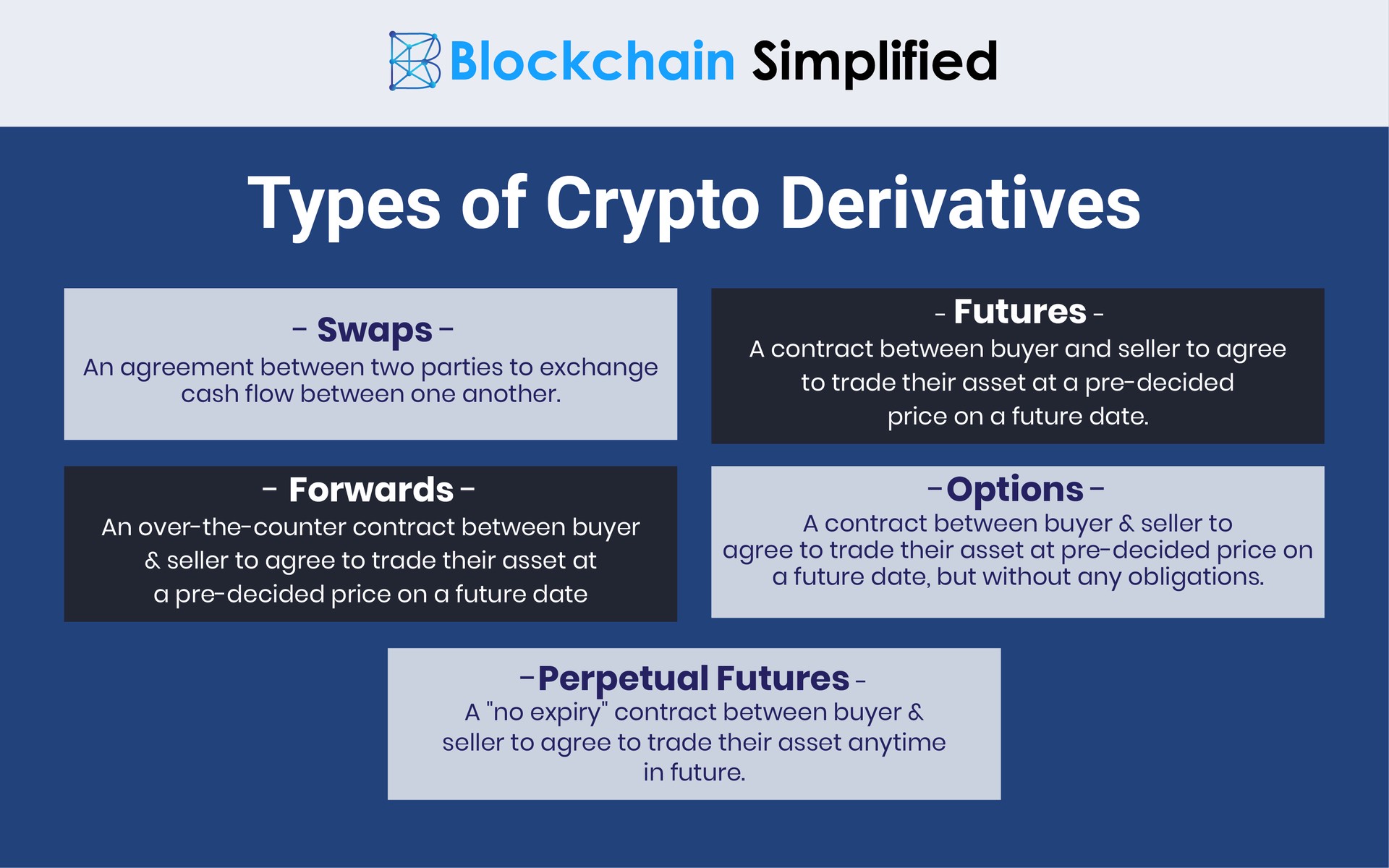

Basically, there are 4 different types of Cryptocurrency derivatives that can be used for derivative trading. Let us take a look at them one by one.

Swaps

A swap generally is an agreement between two parties to exchange cash flow between one another. The most common type of swap is the interest rate swap that comprises the exchange of fixed interest rate payments for a stream of floating-rate payments between two parties i.e. an investor can switch from a floating interest rate loan to a fixed interest rate loan and vice-versa.

Futures

Futures, as we have studied before, is a contract where a buyer and seller both have to buy and sell assets respectively, at a pre-decided price on a future date irrespective of the market price of the asset on that particular date. Futures are always traded on exchanges hence are less risky and more trustworthy.

Forwards

Forwards are exactly similar to Futures, the only difference being that they are traded on over-the-counter exchanges hence are a little risky than Futures.

Options

While Options are also similar to Futures where buyer and seller can agree upon a certain price of the asset to be bought and sold, it is not an obligation for the buyer to actually buy it on that particular date.

Perpetual Futures

There is also a concept of Perpetual Futures where there is no expiry date for the contract. The traders can hold it for any time and execute it whenever they wish to. Perpetual Futures are extremely volatile in nature and have to be dealt with extra cautiousness.

Read more about these derivatives in this article on Types of Derivative Trading.

(To hire the best Blockchain developers, visit us at https://blockchainsimplified.com)

Benefits of Crypto Derivatives trading

Traders swear by Crypto Derivatives trading and that is the reason why many exchange platforms have been extending services for the same. There are many benefits of Crypto Derivatives trading;listed below are a few.

Risk Mitigation against volatile Cryptocurrencies

The prime reason for traders to invest in derivatives trading is to mitigate the risks associated with volatile nature of the asset, in this case cryptocurrencies. As we know, Bitcoin is a highly volatile crypto witnessing severe fluctuations in its prices. Hence, to reduce the risk associated with its continuously varying market price, traders use Bitcoin derivatives trading.

Hedging

In order to reduce the risk of suffering from potential losses, traders and investors use derivatives trading. In the stock market, an investor uses the Put option in derivatives trading to offset the losses arising due to unpredicted situations in future. Thus, Derivatives trading is the best when it comes to hedging risks.

Crypto Price Speculation

Betting and speculating about the price of cryptocurrencies is also a benefit of derivatives trading. Traders use derivatives to bet on the future price of crypto to take advantage of the price fluctuations.

Crypto Derivatives Trading, A promising concept

As seen above, Crypto Derivatives Trading is the ideal risk mitigation technique. Not only investors but even exchange platforms have acknowledged the need for derivatives trading looking at their high demand in the market.

About Blockchain Simplified

Blockchain Simplified is a Top blockchain development company in Pune - India which works on all major Blockchain requirements. We specialise in Blockchain, Web and Mobile development (One Stop Shop for all technology development needs).

Our clientele includes Multiple Funded Start - Ups, SMBs and few MNCs few of which are NASDAQ and NSE listed.

Some of our work includes,

Blockchain based-

hubrisone.com - is a Live app with 100,000+ downloads, All-in-One Cryptocurrency current account. The entire development from scratch carried out by Blockchain Simplified.

All in one Platform - Complete responsibility of entire software development of the platform ,for a $1m funded blockchain start up, led by a team of serial entrepreneurs and tech veterans in Silicon Valley.

Well funded Blockchain startup - Blockchain Simplified helped a $6m funded American Blockchain startup to build the first blockchain protocol to leverage on-chain smart contracts to manage distributed storage of application data off-chain.

Multinational Bank - The company helped one of the top 3 ranking Multinational Banks to integrate various cryptocurrencies into their banking application.

and more…

Non-Blockchain-

SHC - Built entire platform and app from scratch for a $1m funded startup led by a team of Americans including PhD degree holders.

VMW - Developed app for a multi-national company providing mass factory-to-factory shipment services. App is being used by 53 of the Fortune 500 companies such as John Deere, Coca-Cola, Nissan.

and more…

Expertise

Blockchain Development : Bitcoin, Ethereum, Hyperledger, Corda, and more.

Mobile App Development : Android Native, iOS Native, React Native, Flutter, Xamarin.

UI/UX Design : Strategy, Planning, UI/UX Design, Wireframing, Visual Designs.

Web App Development : Node.JS, Angular, React.JS, PHP.

Backend Development : MongoDB, MySQL, AWS, Firebase.

Visit our official website https://blockchainsimplified.com/ for more information.