A quick look into Perpetual Future Contracts

The crypto financial market is booming and is reaching to greater heights, day by day. Not long ago, the only purpose of cryptocurrencies like Bitcoin was money transfer or storage of crypto, although Blockchain and Bitcoin were introduced to the world with a lot of hullabaloo. Cut to a couple of years before, with the advent of Decentralized Finance (DeFi) and real exchanges dealing with other complicated financial services like crypto loans and crypto derivatives, the crypto market was ready for a facelift!

Futures contracts, a type of financial derivatives, are contracts between two parties where they commit to execute the trading of their assets on a future date, for a pre-decided price.

(Good to read blog : Bitcoin Futuress)

In Futures Contracts, the date of the contract execution is fixed, and the buyer and seller of the asset are obligated to buy and sell the commodity on the exact same date, come what may, irrespective of the market price of the asset on that day. This asset can either be a commodity, cryptocurrency, stocks, bonds etc.

A slight variation of the Futures Contracts is attracting interest from traders and investors of the crypto market - the Perpetual Futures Contracts. So what exactly are these Perpetual Future Contracts and why have they suddenly become so popular in the crypto world? Let us understand the concept in this article.

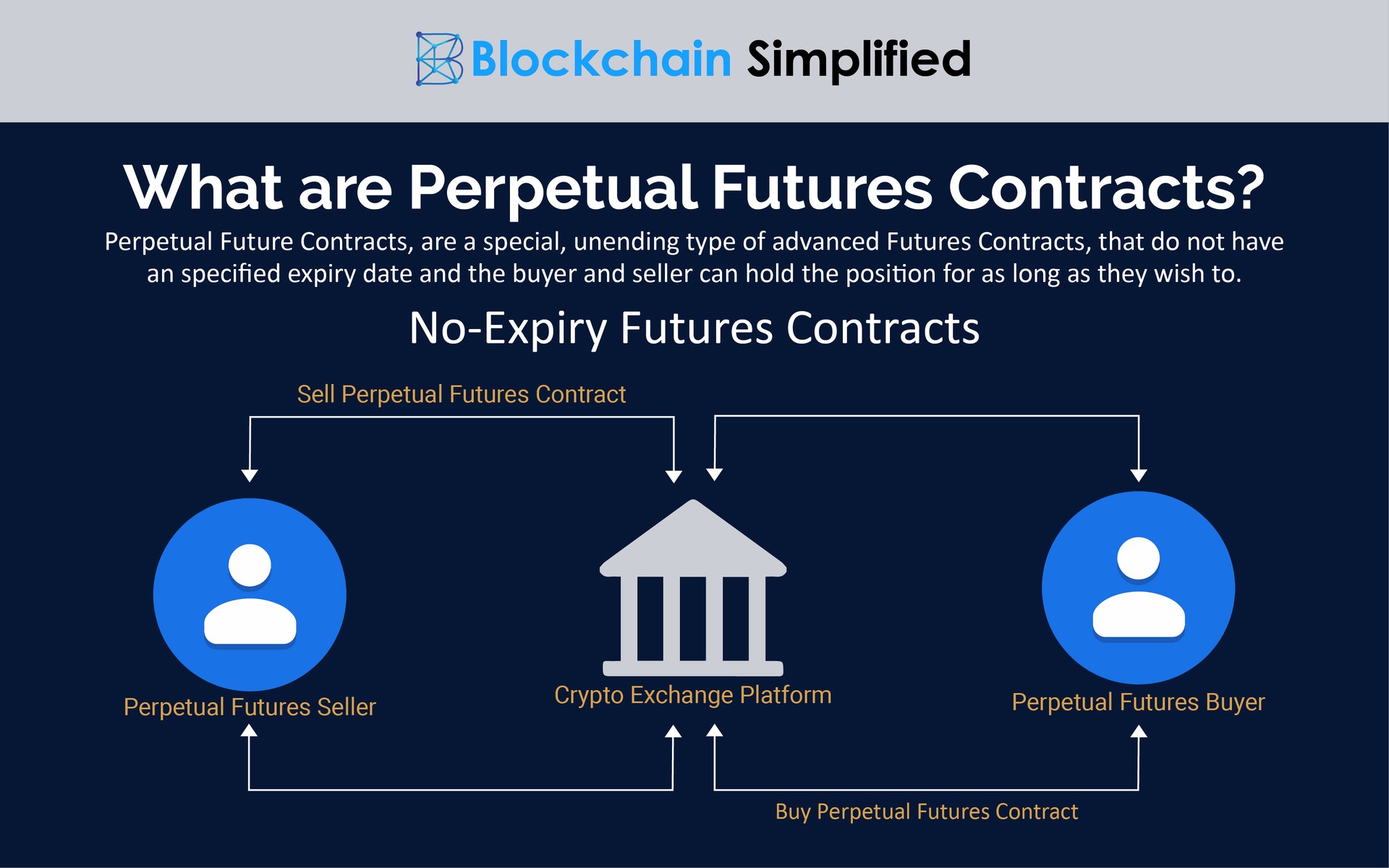

What are Perpetual Futures Contracts?

1) True to their name, Perpetual Future Contracts, are a special, unending type of advanced Futures Contracts, that do not have a specified expiry date which means that the traders viz. buyer and seller can hold the position for as long as they wish to.

2) As in case of Future Contracts, where the buyer and seller are bound to execute the deal on the committed date, Perpetual Future Contracts have no such rules or regulations and the trade can be executed at any time as per the wish of the two participating parties, depending upon the market conditions.

3) Thus, Perpetual Future Contracts enable the seller to sell the asset when its price is susceptible to fall in the future and the buyer can buy the asset if it is expected to witness a price rise in future.

4) The trading of Perpetual Future Contracts is based on an Index Price that is calculated based on the average asset price and its corresponding trade volume.

(To hire the best Blockchain developers, visit us at https://blockchainsimplified.com)

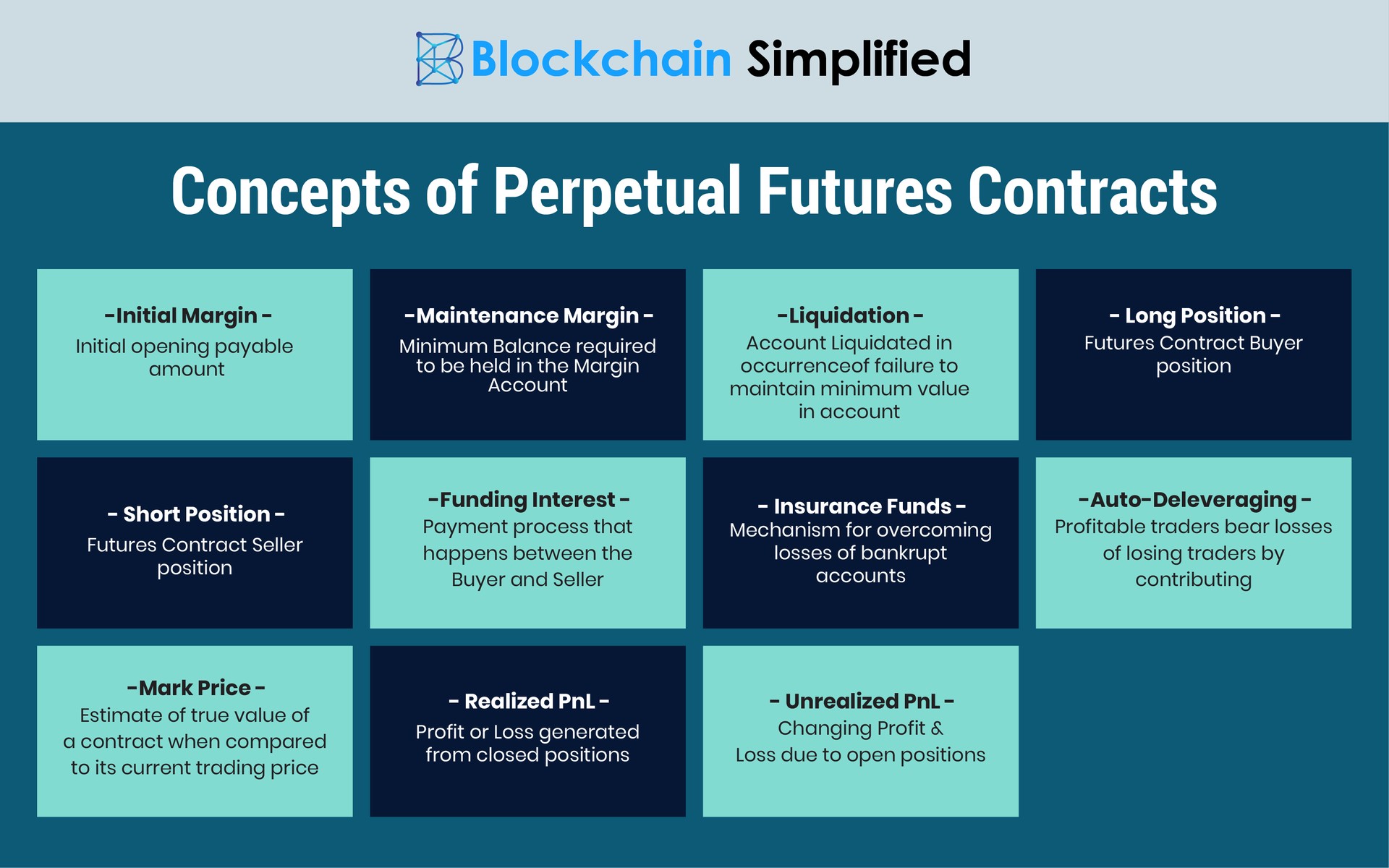

There are few concepts related to Perpetual Futures Contracts that are important to discuss, which are described below.

What are Initial Margin & Maintenance Margin in Perpetual Future Contracts?

In order to leverage trading benefits or open a leverage position to trade in Perpetual Futures Contracts, Initial margin is the minimum amount that a trader must pay at first. This, as we know, is called the Margin Trading or Leverage Trading. Margin trading enables a trader to trade more than what he/she is eligible for. In this case, the trader deposits his collateral in lieu of the margin amount that will be deposited in his margin account. Once the trader meets the eligibility level, he indulges into trading on the exchange. Once the trading is completed, he returns the margin amount with interest.

If Initial margin is the minimum amount required to pay to open a position and a margin account, the Maintenance margin is the minimum balance required to be held in the margin account, in order to keep trading open. The value of Maintenance margin changes according to the market price of the collateral. It is necessary to keep the minimum balance in the margin account in order to stop your account from being liquidated.

Liquidation of Margin Accounts in Perpetual Future Contracts

As explained above, if a trader fails to maintain the minimum balance in his margin account, then his account is liquidated. In case the trader is unable to add additional funds to his account even after multiple margin calls, his account is suspended and the remainder amount in his account is returned to him. The exchange can incur a nominal fee from the trader at the point of liquidation, which is deducted from his margin account.

Long & Short positions in Perpetual Future Contracts

Similar to a Futures contract, even in Perpetual Futures Contracts, the buyer holds the “Long” position which means he commits to buy an asset at a specific price in future; whereas the seller holds a “Short” position and agrees to sell the asset at a pre-decided price. A smart investor takes the Long position when the price of the commodity is low by buying it and sells it at a higher price once its market price increases, by taking the Short position.

(Blockchain Simplified is a top Blockchain development company in Pune, India. Visit us at https://blockchainsimplified.com)

Definition of Mark Price in Perpetual Futures Contracts

Mark Price is defined as the estimated true value of the contract comparable to the current trading price. In the highly volatile crypto market, mark price helps in prevention of future liquidations. It is also a very important factor while calculating the unrealized PnL to gauge whether it is correct and accurate.

About Realized and Unrealized PnL in Perpetual Futures Contracts

An unrealized Profit and Loss (PnL) is calculated when there are still open positions in the perpetual futures contract market, and this number is ever changing. Once these positions hit closure, the unrealized closure is converted to realized PnL.

Refer this article to understand how to calculate realized and unrealized PnL in Perpetual Futures Contracts.

What is Funding interest in Perpetual Future Contracts?

Funding is basically the payment process that happens between the buyer and seller. In case of a positive funding interest which means funding rate above zero, Longers (Buyers holding the Long position) pay the Shorts (Sellers with Short position). On the other hand, if the funding rate is below zero i.e. a negative funding interest, then the Shorts pay the Longs.

If there is a Perpetual Futures Contracts that is being traded on an exchange on a premium rate, then the Longers pay the Shorts due to the positive funding interest, thus paving the way to new Short positions.

More about Funding Rates in Perpetual Future Contracts in this article.

The concept of Insurance Funds in Perpetual Future Contracts

Insurance Funds help a trader secure his perpetual futures account from being liquidated. It is a simple method to safeguard a trader’s account and his collateral. If a “longer” is unable to close a trading position due to market price drop or other reasons, then his account will be liquidated as the balance goes below the minimum required amount. position has to be closed due to a market price drop, it means that his account will be liquidated.

The Insurance Fund is a method that uses the collateral deposited by the liquidated traders to overcome losses of bankrupt accounts. Interestingly, this fund keeps increasing when users are liquidated before the trading positions are closed. Since these positions remain open, the Insurance funds are utilized to cover the losses that were incurred due to open positions.

Read how the Bitmex, an exchange supporting Perpetual Futures Contracts Trading, has managed to hold more than $200 million in its Insurance Funds.

How can Auto-Deleveraging help cover losses in Perpetual Futures Contracts?

In situations where the Insurance Funds are insufficient to cover the liquidation losses, Auto-deleveraging is a method that requires traders who have earned profits, to shell out a part of their profit to cover the losses suffered by the losing traders. Unfortunately, in the crypto trading world, it is a risky mechanism due to its volatile and highly variable nature. While exchanges like Binance make use of an indicator to identify users in the auto deleveraging queue, there are few ways to calculate the ADL rank in Perpetual Futures Contracts, check this article to learn the same.

Why are Perpetual Futures Contracts profitable?

Perpetual Futures Contracts are the most profitable trading instrument and are the best tools to prevent the risk associated with futures contracts. Every big exchange like Binance, BitMex, BitForex, KuCoin, OKEx, Xena offers the services for trading of these futures in order to gain maximum profits.

About Blockchain Simplified

Blockchain Simplified is a Top blockchain development company in Pune - India which works on all major Blockchain requirements. We specialise in Blockchain, Web and Mobile development (One Stop Shop for all technology development needs).

Our clientele includes Multiple Funded Start - Ups, SMBs and few MNCs few of which are NASDAQ and NSE listed.

Some of our work includes,

Blockchain based-

hubrisone.com - is a Live app with 100,000+ downloads, All-in-One Cryptocurrency current account. The entire development from scratch carried out by Blockchain Simplified.

All in one Platform - Complete responsibility of entire software development of the platform ,for a $1m funded blockchain start up, led by a team of serial entrepreneurs and tech veterans in Silicon Valley.

Well funded Blockchain startup - Blockchain Simplified helped a $6m funded American Blockchain startup to build the first blockchain protocol to leverage on-chain smart contracts to manage distributed storage of application data off-chain.

Multinational Bank - The company helped one of the top 3 ranking Multinational Banks to integrate various cryptocurrencies into their banking application.

and more…

Non-Blockchain-

SHC - Built entire platform and app from scratch for a $1m funded startup led by a team of Americans including PhD degree holders.

VMW - Developed app for a multi-national company providing mass factory-to-factory shipment services. App is being used by 53 of the Fortune 500 companies such as John Deere, Coca-Cola, Nissan.

and more…

Expertise

Blockchain Development : Bitcoin, Ethereum, Hyperledger, Corda, and more.

Mobile App Development : Android Native, iOS Native, React Native, Flutter, Xamarin.

UI/UX Design : Strategy, Planning, UI/UX Design, Wireframing, Visual Designs.

Web App Development : Node.JS, Angular, React.JS, PHP.

Backend Development : MongoDB, MySQL, AWS, Firebase.

Visit our official website https://blockchainsimplified.com/ for more information.