All about Uniswap - the DeFi marketplace

One of the most significant differences between centralized exchanges and decentralized exchanges of the cryptocurrency markets is that centralized exchanges almost always offer continual liquidity. Plus, they provide faster settlements and high volume trading. But as we know they are managed and controlled by third parties and centralized entities. Which is why Decentralized Exchanges came into existence. Although they solved the problem of centralized control, DeFi exchanges had their own limitations like performance and most importantly lack of liquidity. These challenges of Decentralized exchanges restricted people’s interest and participation in trading on these platforms. Thus, even though controlled by middlemen, traders showed more trust in centralized exchanges rather than decentralized ones.

Many DeFi exchanges tried to address these challenges but failed to achieve the stability of maintaining liquidity. But one such project that was able to overcome this obstacle was Uniswap. Uniswap is a DeFi protocol that creates automated liquidity.

(Visit us at https://blockchainsimplified.com for your Blockchain development requirements.)

What is Uniswap?

In a typical cryptocurrency trading market, buyers and sellers create liquidity for facilitating token swaps. Uniswap, a revolutionary, decentralized trading platform built on Ethereum blockchain, is a protocol that creates this liquidity automatically, thus making way for token swaps. Created by Hayden Adams in 2018, Uniswap enables traders to swap ETH or ERC-20 tokens on the platform without the need of any middlemen or third party.

Traders exchange tokens on Uniswap without having to trust anyone with their money. They lend their cryptocurrencies to the liquidity pool for which they receive a fee. This algorithmic calculation and pricing mechanism of Uniswap is governed by smart contracts on Ethereum that determine the value and the swapping rate depending on actual demand of the tokens in the market, balances of the participating tokens and other various factors.

How does the Uniswap protocol work?

Uniswap works along a design model called as the Automated Market Maker (AMM). As mentioned above, these market makers are nothing but smart contracts that generate the liquidity pools. Liquidity providers contribute liquidity to liquidity pools by lending their cryptocurrencies/tokens. Although these pools are generally made up of stablecoins like DAI, USDC, or USDT, that is not a mandate. It can also be an automated liquidity pool of ETH or ERC-20 tokens.

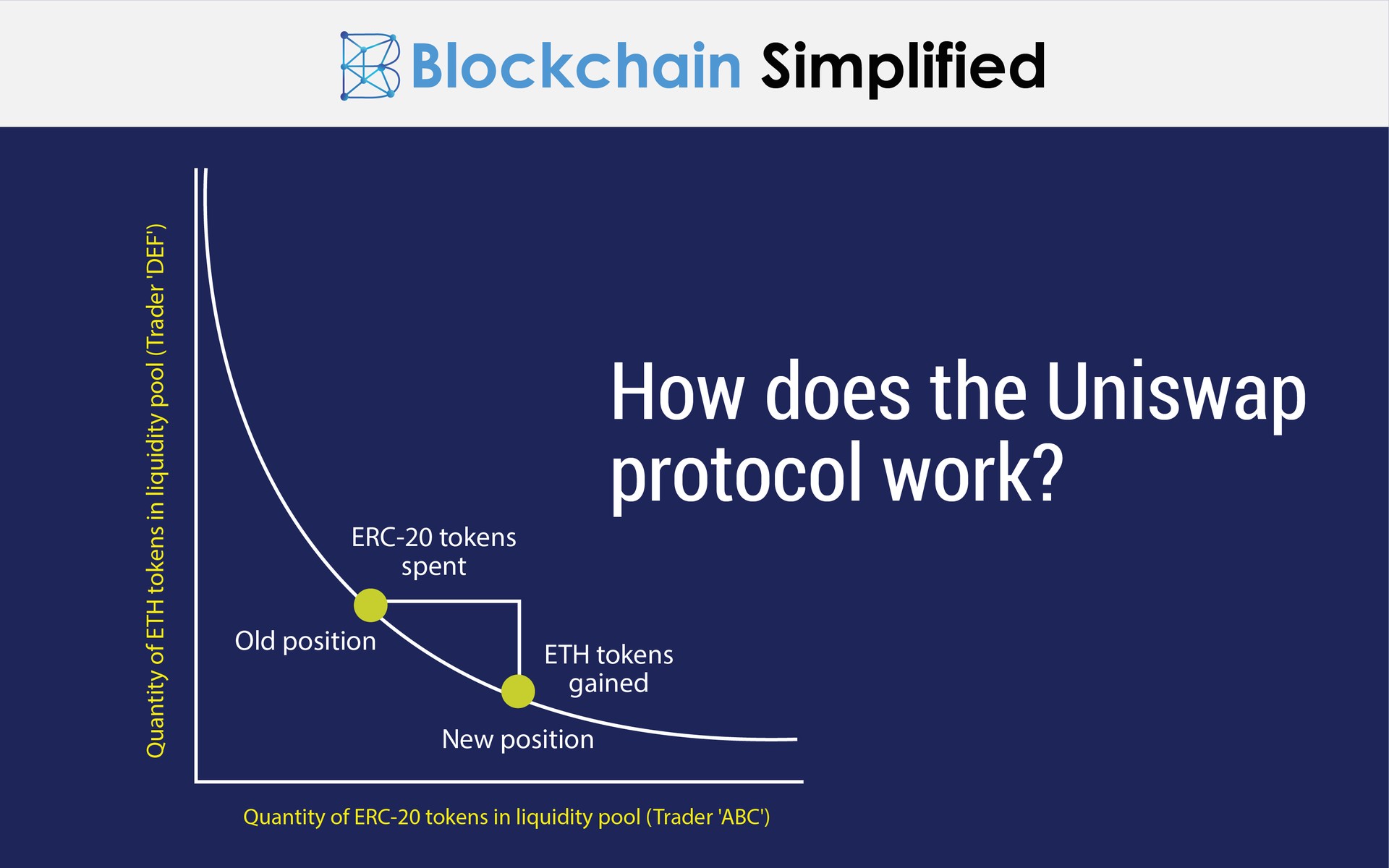

To understand how Uniswap protocol works, let us consider an example. Refer the graph below.

1) Suppose trader “ABC” wants to swap tokens with “DEF”, where ABC possesses ERC-20 tokens and DEF has ETH tokens.

2) Uniswap follows the “X * Y = K” equation, where the X is trader “ABC” representing ERC-20 and Y is trader “DEF” representing ETH.

3) K represents a constant that is set by the creators of the exchange contract on Uniswap. K represents the total liquidity in the pool that should always remain constant.

4) When “ABC” decides to swap his ERC20 tokens with ETH tokens of “DEF”, the balance of ETH decreases whereas that of ERC-20 increases, which simply means that there are more ERC-20 tokens in the liquidity pool now than ETH.

5) The price of ETH now goes up because there is less ETH in the pool now. It is simple economics of increasing the price when there is scarcity.

(https://blockchainsimplified.com is a top blockchain development company in Pune, India.)

Why Uniswap?

Uniswap and its automated liquidity provisioning has established the much required trust in the DeFi space. More and more traders are realizing trading opportunities on the platform and are coming forward to participate. Not only is Uniswap completely decentralized in nature, but is also low-cost compared to other decentralized exchanges. Any liquidity provider can deposit funds to the liquidity pool and earn fees. Uniswap, thus, enables seamless token swapping between traders.

About Blockchain Simplified

Blockchain Simplified is a Top blockchain development company in Pune - India which works on all major Blockchain requirements. We specialise in Blockchain, Web and Mobile development (One Stop Shop for all technology development needs).

Our clientele includes Multiple Funded Start - Ups, SMBs and few MNCs few of which are NASDAQ and NSE listed.

Some of our work includes,

Blockchain based-

hubrisone.com - is a Live app with 100,000+ downloads, All-in-One Cryptocurrency current account. The entire development from scratch carried out by Blockchain Simplified.

All in one Platform - Complete responsibility of entire software development of the platform ,for a $1m funded blockchain start up, led by a team of serial entrepreneurs and tech veterans in Silicon Valley.

Well funded Blockchain startup - Blockchain Simplified helped a $6m funded American Blockchain startup to build the first blockchain protocol to leverage on-chain smart contracts to manage distributed storage of application data off-chain.

Multinational Bank - The company helped one of the top 3 ranking Multinational Banks to integrate various cryptocurrencies into their banking application.

and more…

Non-Blockchain-

SHC - Built entire platform and app from scratch for a $1m funded startup led by a team of Americans including PhD degree holders.

VMW - Developed app for a multi-national company providing mass factory-to-factory shipment services. App is being used by 53 of the Fortune 500 companies such as John Deere, Coca-Cola, Nissan.

and more…

Expertise

Blockchain Development : Bitcoin, Ethereum, Hyperledger, Corda, and more.

Mobile App Development : Android Native, iOS Native, React Native, Flutter, Xamarin.

UI/UX Design : Strategy, Planning, UI/UX Design, Wireframing, Visual Designs.

Web App Development : Node.JS, Angular, React.JS, PHP.

Backend Development : MongoDB, MySQL, AWS, Firebase.

Visit our official website https://blockchainsimplified.com/ for more information.